Spring/Summer 2023 Real Estate Update

One year removed from the Bank of Canada’s decision to raise interest rates (repeatedly) and our local real estate market is looking to bounce back!

Last month’s decision to hold the rate was a welcome (some would argue overdue) announcement.

The interest rate increases that began over a year ago led to a decrease in not just average sale price but also demand for real estate across most regions in Canada.

As a result, Sellers had to adjust their expectations and lower their asking prices until, if they were lucky, they found their Buyers.

Buyers just sat back and waited as they watched prices return and hover around our “historic trend line” for our local region.

At the beginning of March we noticed new listings starting to sell consistently and felt the market “flattening” as it began to balance out. This has continued since then.

The bottom of the correction is here but now where do we go? For the first time in 10-12 months we are seeing pending sales start to overtake new listings.

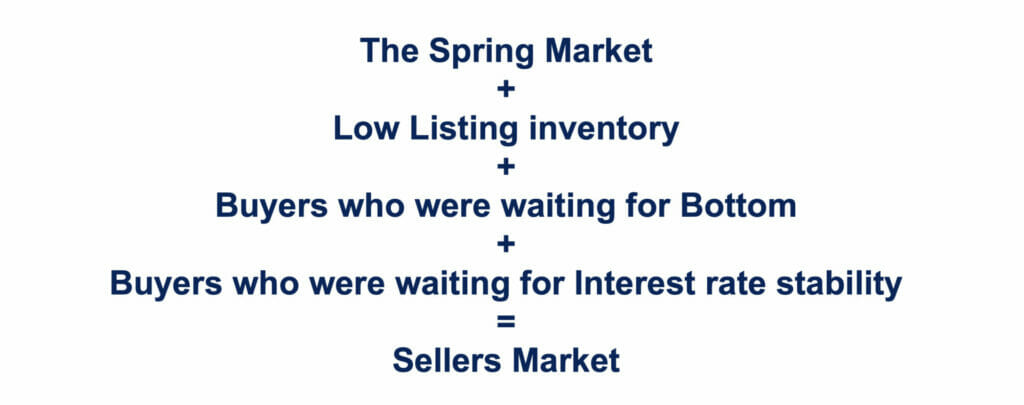

The spring market is here! We have low inventory; we have Buyers who were waiting for the bottom and Buyers and Sellers waiting to see what the Government’s plan was for interest rates.

This recipe will lead to an active Spring and Summer:

Buyers are Ready!

After the long correction where Buyers sat back and watched prices free fall over the past 10 months, the market has stabilized and they are ready to buy!

Buyers have seen new listings come up and sell straight away over the past few weeks, often in competition. This further adds confidence to eager Buyers, that the time is now!

Buyers are ready, they are approved, they know what they want; however there are very limited active listings out there.

Sellers are Ready!

After a year where Sellers watched prices drop week after week after week, the bottom of the correction has come. Currently new listings, when priced right, are getting lots of attention and selling quickly.

Sellers are optimistic that average days on the market will continue to drop.

Down to an average of 27.6 days to sell in March from 31.2 days in February from 37.8 days in January. And April is already feeling much lower!

What could change? What could slow down this momentum?

Government intervention… again

- One of two options could happen moving forward in response to this potentially active Spring Market:

The Government raises the interest rates again and/or implements further lending restrictions and rules to slow down the market. - The Government says “okay great, inflation is down, economy is moving again, lets lower the rates in 2024.”

I do not anticipate the Government raising interest rates again anytime soon. And while they might not lower them immediately, I do think we will see them continue to stabilize.

I do anticipate the mortgage lenders will continue to lower their rates to be more competitive further helping fuel the active market along.

U.S.A banking turmoil further supports our Rates declining through 2023

Even before fallout from the recent and on-going banking issues in the US (and their global consequences) It was my prediction that the rates will not rise in 2023 any further. Most signs and economists are predicting that we will see the key interest rate start to decline by Q3-Q4; in fact we are already seeing it.

What about the Recession?

We have been in an inverted Bond yield curve for many months now. Without getting too much into the weeds on this, yes, a yield-curve inversion often precedes a recession. Basically, the return you get on a short term Bond is higher than the Return you get on a long term investment.

I believe we are going to have a soft landing and the Bank of Canada will continue hold and potentially even retract their benchmark rate.

Leading to:

- Demand for housing will continue to increase

- New housing supply will not be able to keep up with demand

- Global Supply issues will continue to be addressed

- Inflation will calm down and the BoC will stop raising rates

- 5 Year mortgages will come down .65-.85% from their peak

- Variable rates are HIGHER than the long term mortgage

- Yes, there will still inflation (grocery prices up 11% since last year) but 2nd highest contributor is these darn interest rates themselves!

National Level:

With National sales more or less stable since the summer, this suggest that perhaps the downward adjustment on sales volume and average sale price as a result of the rising interest rates may be behind us.

Yes, it is still difficult for first time home buyers and even gainfully employed couples to afford some of these prices but some buyers are going to start to come off the sidelines as confidence that rates have topped out starts to spread.

Prices will be relatively stable for 2023 (perhaps a slight decrease in some markets) but 2024 is forecasted to see a 10.2 % increase (CREA) signifying further evidence the bottom is here.

In Summary:

Change already afoot with 2023 Listings:

I have noticed the change already. Just these past three weeks there were a hand full of NEW listings that sold straight away. And some with multiple offers. Some common themes of these homes:

- larger homes where buyers are typically moving up into

- Lower priced homes (sub $800,000)

- Priced well for Current market (forgetting about the peak of 2022)

- Sellers quickly dealing with any and all offers that came to the table – no longer playing games

Remember we had RECORD months in January – March of 2022. So when data is released for the 2023 months comparing them to January – March the dramatic decline is going to look very bad.

Remember there is a story behind ALL Real Estate transactions that go beyond public knowledge.

Comparing any recent Real Estate statistic to last year’s peak months is always going to look stark in comparison.

So what is the real story?

As our market began to balance out over the past few weeks both Buyers & Sellers are becoming more acclimatized & sales are increasing.

Home sales have been increasing over the past few weeks as Buyer confidence in our market is rising.

Multiple offers are back – but properties are still selling for reasonable prices.

Want to chat more? Reach out anytime!

</font colour= “0B255A”>